Having dealt with an overview of Oracle Fusion and the Functional Setup Manager (FSM), we will continue from Common Application Configuration(Part 1)

The topics covered in this second part of the tutorial are:

● Legal Entities, Divisions and Business Units

● Reference Data Sets

● Enterprise - A Use Case

● Enterprise Structures Configurator

● Legal Jurisdictions and Authorities

● Legislative Data Groups, Payroll Statutory Units, Legal Employers, Tax Reporting Units

Legal Entities

A legal entity is a recognised party with rights and responsibilities provided by the legislation and enforced through the judicial system. In Fusion, the task associated with this is Manage Legal Entities.

The responsibilities may include: owning property; trading; repaying debt; and accounting for themselves to regulators, authorities, and owners according to specified rules in the relevant legislation.

A legal entity has to be defined for each registered company or any other entity recognised in law; for which you would want to record assets, liabilities, expenses, income, pay transaction taxes, or perform intercompany trading.

Divisions

There are subdivisions within an enterprise, in which each division organises itself differently in order to deliver products and services or address different markets. In Fusion, the task associated with this is Manage Divisions.

A division can operate in one or more countries. It can also be comprised of many companies or parts of different companies that are represented by business units.

Each division is a profit centre or a group of profit and cost centres, where the division manager is responsible for attaining goals that include profit goals. Divisions are used in Human Capital Management (HCM) to define the management organisation hierarchy using the generic organisation hierarchy.

Business Units

A Business Unit is a unit of an enterprise that performs one or many business functions that can be rolled up in a management hierarchy. The lowest level of profit and loss is mostly driven by business units, rather than divisions. In Fusion, the task associated with this is Manage Business Units.

A business unit can process transactions on behalf of many legal entities. Each business unit has a manager, specific strategic objectives, and a level of autonomy. It is responsible for its own profits and losses.

Business units are mainly used for management reporting, transaction processing, security of transactional data, and reference data definition and sharing.

Reference Data Sets

A SetID is used to tag data as a part of a reference data set. The reference data sets can then be scanned into a particular module which can then use all the data within the set. This facilitates the sharing of configuration data, such as jobs and payment terms, across organisational divisions or business units. In Fusion, the task associated with this is Manage Reference Data Sets.

Reference data sets need to be defined to determine how the data is shared or partitioned. They are mainly used to reduce duplications and maintenance. This is done by sharing common data across business entities, wherever appropriate.

By default, a common reference data set is used.

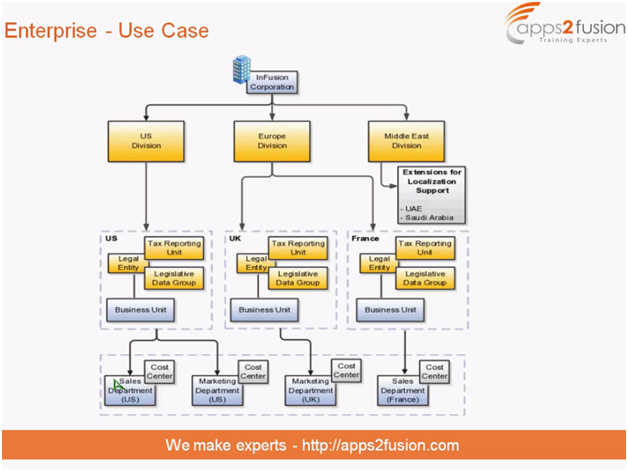

Enterprise - A Use Case

To understand how an enterprise works, let us look at an example:

InFusion Corporation is a multinational enterprise in the petroleum refining and polyester industry. Their primary locations are in the US and the UK, but they also have smaller outlets in France, Saudi Arabia and the United Arab Emirates (UAE).

In the US, InFusion employs 4,000 people and has a company revenue of $5 billion. Outside the US, there are 2,000 people and a revenue of $1 billion.

As far as analysis is concerned, the US division covers the US locations, the Europe division covers the UK and France, while Saudi Arabia and the UAE are covered by the Middle East division.

Fig. 1 - A representation of the case

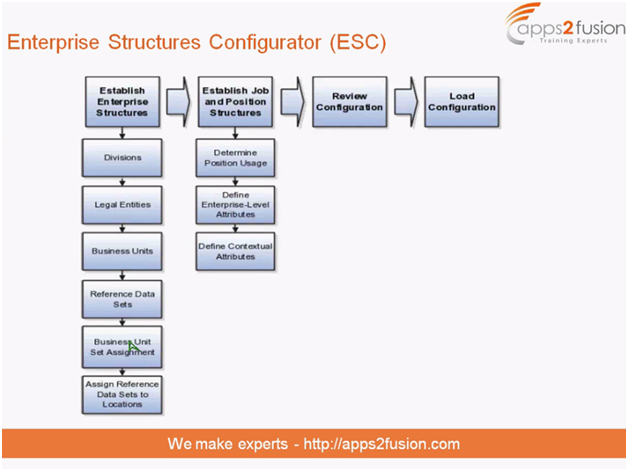

Enterprise Structures Configurator

<-->The Enterprise Structures Configurator (ESC) is an interview-based tool that guides you through the process of setting up a basic enterprise structure. It is available in the Enterprise Structures Guided Flow feature for the offerings on the Configure Offerings page.

Depending on your answers to the questionnaire, the tool creates a structure of divisions, legal entities, business units, and reference data sets that reflect your enterprise structure. There is also a guided process to set up jobs and processes.

You can create multiple configurations, review and compare them, and load a particular configuration. A rollback of the configuration is possible as long as it has been loaded by you.

Fig. 2 - The operation of the ESC

Legal Jurisdictions and Authorities

<-->Jurisdictions

A jurisdiction is a physical territory, such as a group of countries, country, state, county, or parish, where a particular piece of legislation applies. There are three types of jurisdictions: Identifying Jurisdiction, Income Tax Jurisdiction, and Transaction Jurisdiction.

Legal Authorities

A legal authority is a government or legal body that is charged with powers to make laws, levy and collect fees and taxes, and remit financial appropriations for a given jurisdiction.

The tasks associated with the legal aspects in Fusion are: Manage Legal Jurisdictions, Manage Legal Address, Manage Legal Authorities; Manage Legal Entity, Manage Legal Entity Registrations; and Manage Legal Reporting Unit.

Legislative Data Groups

They are used for partitioning payroll and related data by marking a legislation in which payroll is processed. At least one legislative data group is required for each country where the enterprise operates.

Legislative data groups can be associated with one or more payroll statutory units, but a payroll statutory unit can belong to only one legislative data group. A legislative data group is associated with a legislative code, currency, and its own cost allocation key flexfield structure.

Payroll Statutory Units

They are legal entities responsible for paying workers, including the payment of payroll tax and social insurance.

A payroll statutory unit can pay and report on payroll tax and social insurance on behalf of one or more legal entities. Of course, this depends on the structure of your enterprise.

Legal Employers

A legal employer is a legal entity that employs workers.

Legal employers are captured at the work relationship level. All employment terms and assignments within that relationship are automatically with that particular legal employer.

Tax Reporting Units

They are responsible for grouping workers for the purpose of tax and social insurance reporting. They are the HCM’s version of the legal reporting unit in Oracle Fusion Applications.

When a legal entity is selected as a payroll statutory unit, the application transfers the legal reporting units associated with that legal entity to Oracle Fusion HCM as tax reporting units.