SAP ERP provides various sub-ledgers in Financial Module, Accounts receivables plays an utmost important part in the Sales Cycle. The major process can be overviewed below. It helps in processes like credit management, Payment receivables, Invoicing, etc. The process can be SAP standard and can be customized as well as for industry specific requirements.

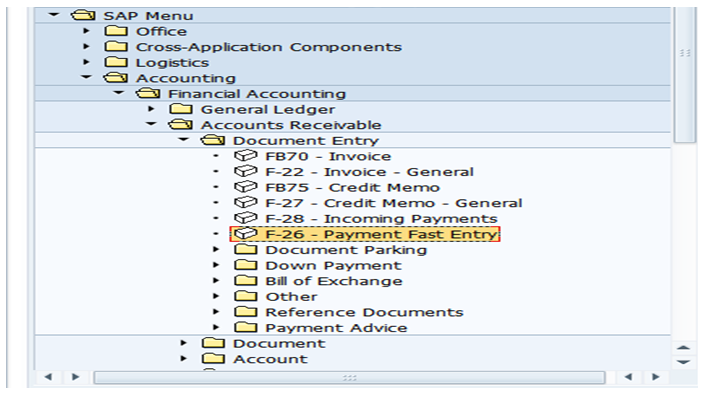

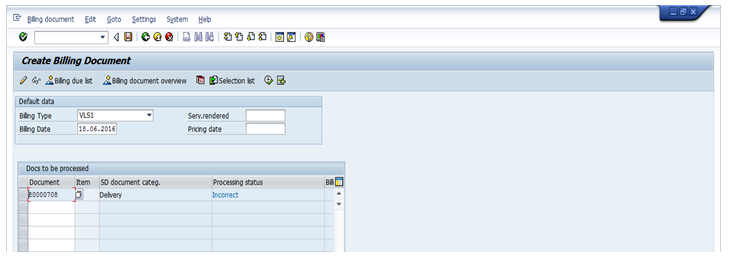

Let us see some important Account Receivables processes.

Customer Master Data

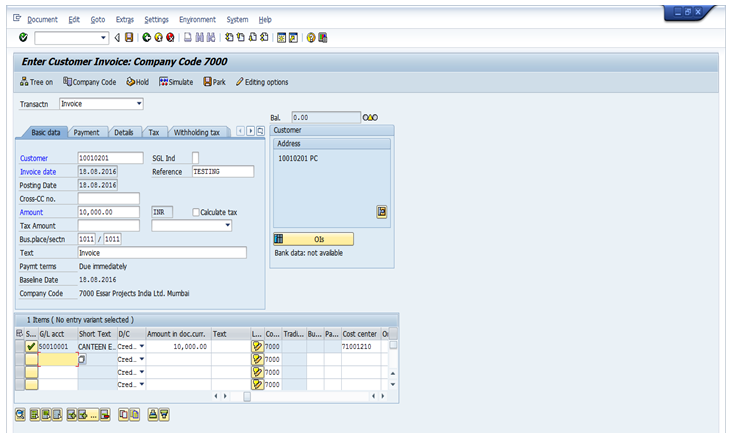

Customer Master is made of all the business partner/clients related information. The various details regarding each customer are to be mentioned in different field under multiple tabs on the SAP Master data Screen while creating the same. Once they are created in the system we can use these master data for various business transactions. The Customer Master data has three segments:

- Chart Of Accounts Segment/General Data

- Company Code Segment

- Sales Area Segment.

All the required Data is to be mentioned in the fields. Some of the Fields in SAP are compulsory to be filled. How does SAP maintain this discipline?

There is a concept in where a particular field can be defined as either of the below four options:

- Required

- Optional

- Hidden

- Display

This concept in SAP is called the Field Status of a particular field. SAP provides a lot of fields into which data can be entered for every customer. Depending on the business requirements, some of the fields may be needed to be made mandatory while some fields may not be required at all. The field status is assigned to the customer account group. All the customer masters assigned to a particular customer account group follow the field status settings that are assigned to the customer account group. SAP allows any field to have four statuses as follows:

- REQUIRED: The user while creating the customer master must enter a field, which is set as required. All important fields for a business should be set as required so that they are not missed while creating a new customer master.

- OPTIONAL: A field, which is set as optional, can hold data or it can be left blank by the user.

- HIDDEN: A field, which is set as suppress, is not displayed while creating the customer master. All fields which are unnecessary and are never to be used by a business should be set as suppress. However, care should be taken before setting the field status as suppress to ensure that it will not be used later. If there is doubt, then it is better to leave the status as optional.

- DISPLAY: A field with the display status is only displayed and cannot be modified by the end user.

The below screen will help in understanding the various fields in each segment of the Customer Master Data.

Master Data once created the following activities can be done as per maintenance of the master data.

- Change Customer Master Data

- Block/Unblock Master Data

- Mark For deletion

The way GL accounts are grouped in GL Account Groups the Customer Account groups are also grouped in SAP with Account Groups. For example, they can be grouped as Sold to Party, Ship to Party, One time customers, Bill to, and so on.The Account Group has some control functions which are:

- Number Ranges for the Customer Master Data

-Internal Number Assignment

-External Number Assignment

- Field Status of the Customer Master Data

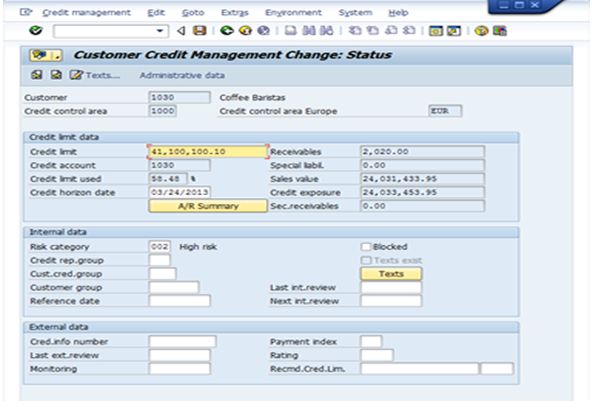

Customer Credit Management

Credit Management is maintained parallel to the Customer Master Data. It is used to minimize the credit risk by defining credit limits for each customer. This is particularly used in financially unstable industries or companies. The credit checks work in the system in specific criteria and scenarios. The user can also specify at which important check points these checks need to be triggered by the system in the Sales Cycle, for example, Sales Order, Delivery, etc.

Credit Management Master Data:

The credit management master data is also to be maintained in the tab of the customer master record.

Central Data:

Contains information for the current credit limit assigned and maximum permitted credit limit

- Total Amount

- Individual Amount

Status

Contains information of the customer as on current basis the credit limits used and the percentage used

- Receivables

- Current Liabilities

- Sales Value

Internal Data

Contains information on the customers' risk category and whether a particular customer is blocked for any transaction.