Withholding tax is applicable in few countries which have withholding tax. SAP ERP has an excellent solution for implementing TDS.Withholding tax is an Income tax, which is deducted at the source of the revenue. The party that is subject to tax does not remit the withholding tax to the authorities himself.

In any business transaction there are 2 parties involved. One is the customer and another is the vendor. A customer is authorized to deduct withholding tax for services rendered by the vendor. When the vendor raises the invoice on the customer, the customer deducts the withholding tax as per the rates specified by the tax authorities and pays the balance money to the vendor.

The tax deducted by the vendor is remitted to the tax authorities on specified due dates. The vendor gives a Withholding tax certificate to the customer for the withholding tax deducted.

The customer can claim this withholding tax (as advance income tax paid) in his annual returns to Income tax authorities.

In some countries (like India) the withholding tax is deducted on Invoice or payment whichever is earlier. Thus when an advance is paid to the vendor the customer is required to deduct withholding tax o n the advance payment. When the Vendor submits an Invoice the customer is now required to deduct tax on the Invoice amount reduced by the advance amount.

To calculate pay and report the withholding tax, the SAP system provides two

Functions: -

Classic Withholding tax

Extended Withholding tax

Extended Withholding tax includes all the functions of classic withholding

Tax; SAP therefore recommends the use of extended withholding tax.

Below is the necessary configuration required for Withholding Tax.

Configuration:

Basic Settings

-Check Withholding Tax Countries:

The country for which the WTH needs to be activated in the system this configuration needs to be selected. Which is a one-time activity. Once activated the system is activated with the WTH.

-Define Official Withholding Tax Codes

The WTH slabs applicable in a country can be configured in the following configuration. The example of the configuration can be as below as per the Indian Tax deducted at Source.

194I – Rent

194C – Brokerage

194J– Professional Services

-Define Reasons for Exemption

In some particular scenarios government gives exemption in the applicability of the tax applicable under services or a span of time period or to some customers or vendors, the reasons for the same is to be maintained here.

-Check Recipient Types

Two types of recipient exist In the WTH

Company – CO

Others - OT

To specify the recipient type this needs to be maintained in the Vendor or Customer master record particularly indicating the type.

-Define Business Places

Area wise, state wise bifuracation in WTH GL Accounts require the creation of Business Place. It further helps in posting and reporting state wise WTH separately. Also the clearing of the WTH happens state wise individually. Hence state wise Business place is a must. We can also have Section Codes in cases where in one state, bifurcation is required.

Calculation

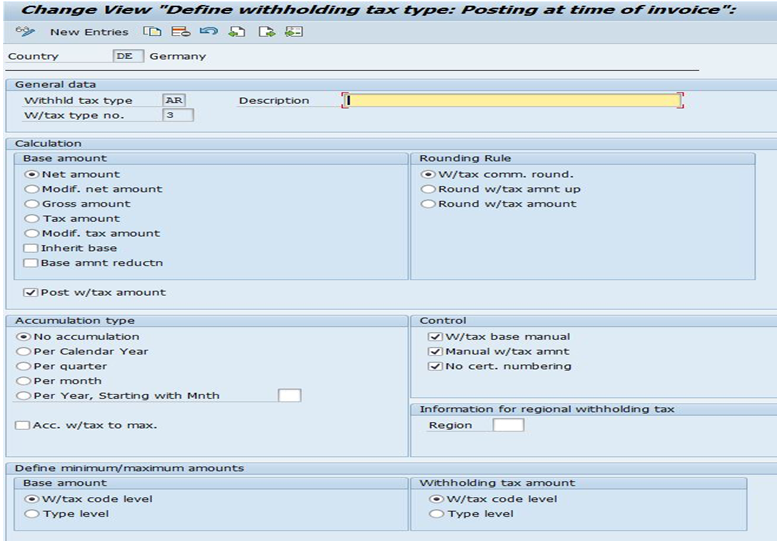

-Withholding Tax Type

The Various WTH Types under section can be as below example

TDS Invoice for rent Sec 194I

TDS Payment for Rent Sec 194I

TDS Invoice for professional Services 194J

TDS Payment for Professional Services 194J

TDS Invoice for Brokerage Sec 194C

TDS Payment for Brokerage Sec 194C

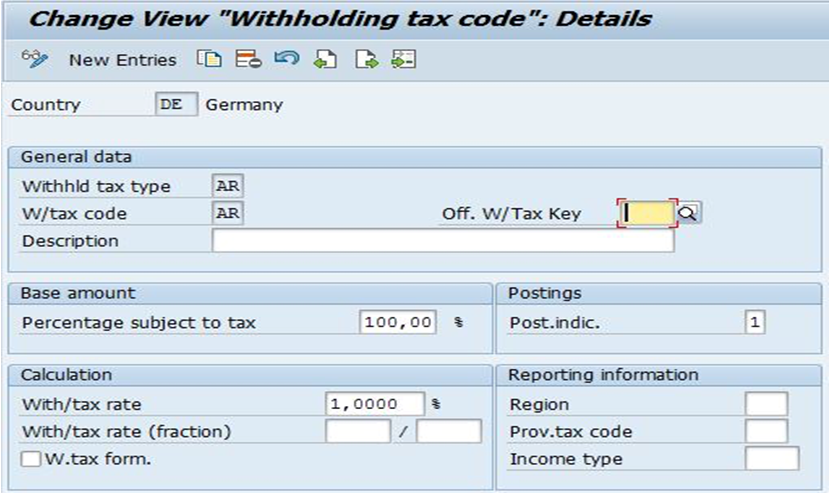

-Withholding Tax Codes

The percentage under the WTH types can be configured as Tax codes.

-Withholding Tax Base Amount

Tax base needs to be specified whether net gross and so on.The various options are as shown in the screen shot for WTH Types.

-Minimum and Maximum Amounts

Minimum and maximum amounts on which the TDS needs to be deducted can be specified under this configuration.

Company Code

-Assign Withholding Tax Types to Company Codes

The Tax Codes created in the system needs to be individually assigned to the company code to make use of the tax code. This assignment is a necessary configuration every time a new tax code is created in the system.

-Activate Extended Withholding Tax

Finally activate the Extended WTH in the system the following configuration is to be made.

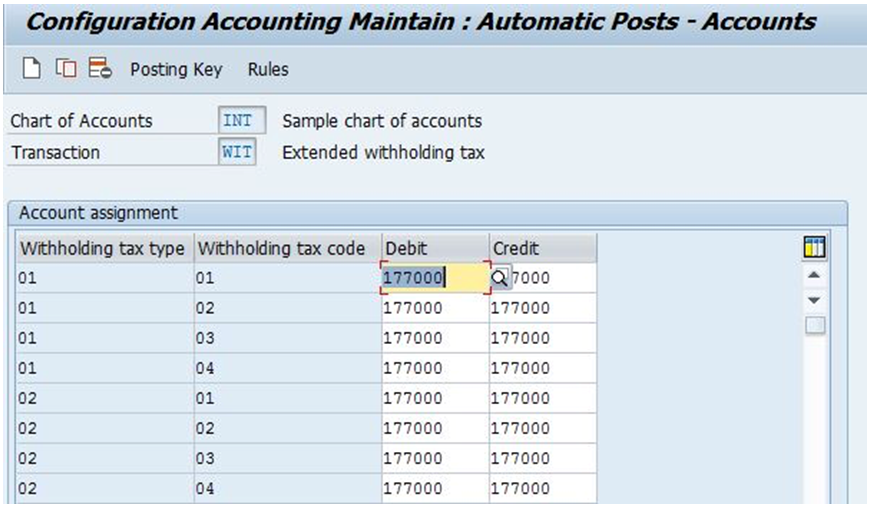

Postings

-Define Accounts for Withholding Tax to be Paid Over

NOTE:There exists a separate table in SAP if configuration of WTH GL Accounts where the WTH is based on Business Place and Section code J_1IT030K_V.

Generic Withholding Tax Reporting

-Define Output Groups

The print related information is to be specified in the output groups. Spool request, output device etc.

-Define Forms for Withholding Tax Reporting

The letter format for the TDS certificate to be printed from the system for each line item, vendor, customer, has to be specified here. SAP provides some country specific forms, which we can use. We can also copy the same and edit as per our requirements.

-Define Certificate Numbering for Extended Withholding Tax

Each TDS form printed by the system has to be numbered so as to have a certificate numbering. Hence we need to maintain number range for the system to derive TDS certificate numbers.

Master Data :

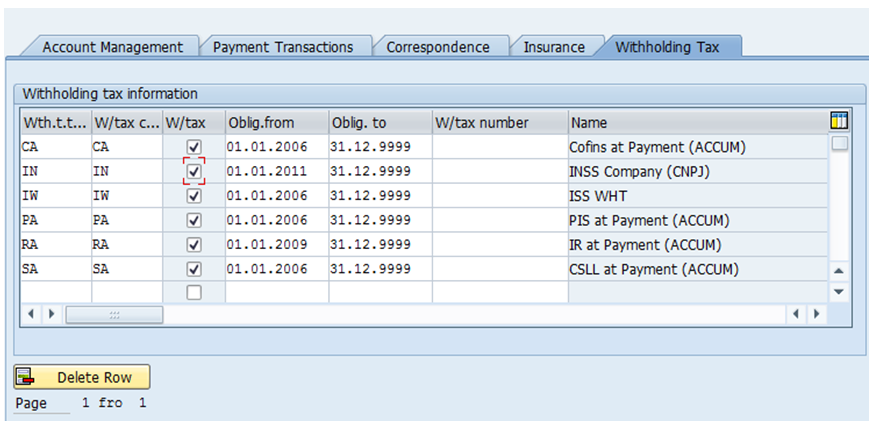

Vendor/Customer Master Data Maintenance

-Update withholding tax codes in the vendor /Customer master

-Go live checks when uploading Vendor Master Data and Vendor open items

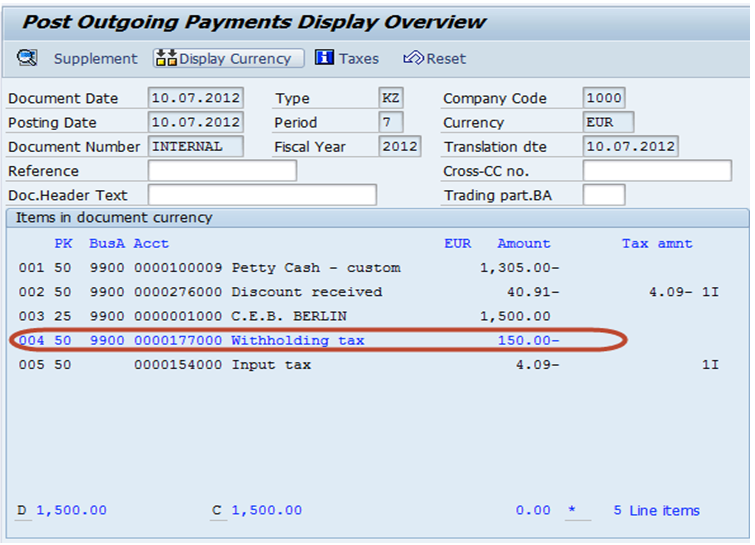

An Example of TDS deducted at the time of Payment Entry in Sap.