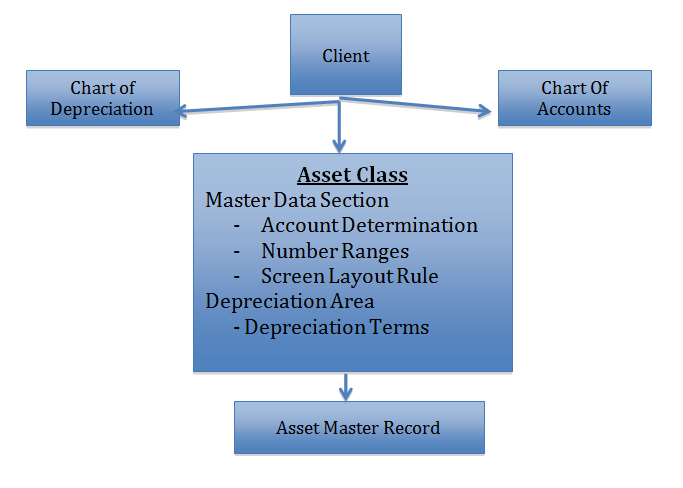

In your enterprise there are multiple number of assets, after considering the entire existing assets, your company can have Asset Classes created for grouping this assets. The different type of Asset Master records forms the structure of the Asset Classes. Like Customer and Vendor and GL Master Records are grouped by Account Groups, Asset Master records are grouped by Asset Classes. Account groups are also at Client level and can be used by all the company Codes. Asset Accounting is activated in SAP Financials if below configuration settings are maintained.

- Company Code is Created

- Chart Of Account is Created and Assigned to the Company Code

- Chart Of depreciation is created and assigned to the Company Code

- Asset Classes are created

- Controlling (CO Account Assignments) Object is created in the System.

- GL Accounts Area Created for Postings like Deprecation, acquisitions, retirement, write off etc.

Therefore the major functions of an Asset Class would be:

- Asset Class is the means of structuring or grouping of Asset Master records.

- Asset Class is at the Client Level and hence applied to all the Company Codes.

- Asset Class is the main criterion in all the Standard Reports in SAP.

- The default values maintained in the Asset Class automatically flows in the Asset Master Record created in the Asset Class.

- Different Valuation types can be taken care of with Asset Classes.

- Account Determination is as per each asset class.

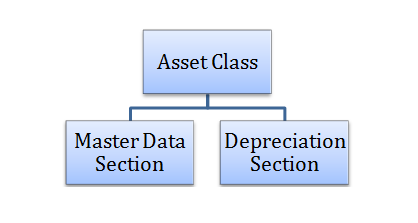

Asset Class consists of two main sections:

Master Data Section: With Control Data and Default Values for the Administrative data in the asset master record.

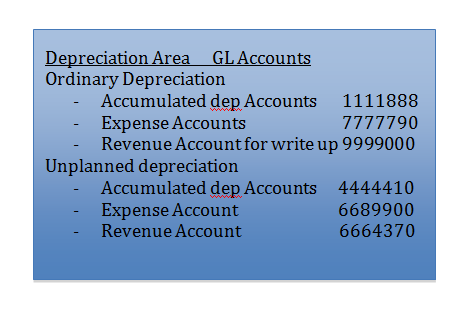

Depreciation Section: With Control Parameters and default values for depreciation terms for each depreciation area

Org Structure Overview Asset Accounting

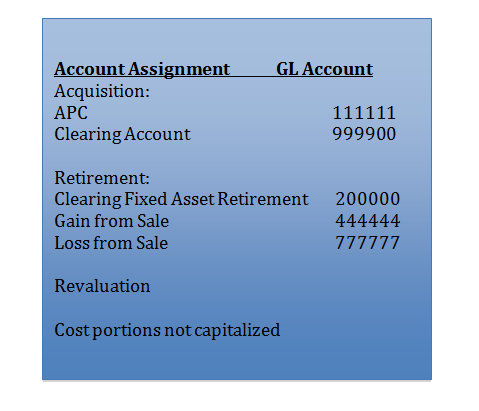

- Account Determination:

- Asset Class links Asset Master records and their Values to GL Accounts through Account determination key(Account Assignment).

- Account determination key can be identical to the account number of the fixed asset balance sheet account if you only transfer asset values in one depreciation are in the general ledger and have a relatively small asset class.

- Several Asset Classes can use same Account determination key.

Number Range:

The Number range controls the assignment of the number of asset master record. You define number assignment as either internal or external. The asset Class controls the asset number.

Screen Layout Rule:

Screen layout determines which input fields in the asset master records can be processed or whether these fields are to be defined as required fields or if the fields are not displayed at all. This helps in

- Reducing the master data field maintenance

- Ensure important fields are entered

- Maintenance level of master data fields can be determined

Asset Class level

Main Asset Number level

Sub number level

- Ensures uniformity of assets under same Asset Classes.

- Tab Pages to be shown in the asset master screen can also be controlled

Number of pages

Names of the pages

Logical field groups.

Special Asset Classes:

- Asset Under Construction

- Low Value Assets

AUC –Asset Under Construction

AUC requires a separate asset Class and corresponding GL Account, because they have to be shown separately in the Financial Statement. Moreover the AUC process is also different as per the Account principles.

By choosing Standard depreciation key 0000 you can ensure that no depreciation is calculated for AUC. But special Tax depreciation and investment support are also possible for assets under construction.

You can also enter down payments on assets under construction in accounts payable accounting processes.

Even after an asset under construction has been fully capitalized, you can still post credit memos.

Investment Management (IM) is available to help you manage more extensive asset investments. It integrates internal orders and projects with AUC.

Low Value Assets:

You can choose whether to manage low value assets (LVAs) using individual management or collective management. For each type of management, you have to set up a separate asset class.

If you select collective management for low value assets a base unit of quantity must be specified for this asset class.

When posting, check against a permissible maximum amount.