Oracle Fusion Tax provides a centralized, global solution for managing transactions-based tax requirements across Oracle Fusion Applications. Oracle Fusion Tax automates transaction tax calculation, tax determination, and tax reporting functions across business documents, such as sales invoices, purchase requisitions, purchase orders, and supplier invoices. Users can quickly configure transaction taxes according to local and international tax requirements.

Countries, states, and federations around the world derive substantial parts of their income by taxing business transactions. A major part of operating cost is compliance with various transaction tax rules and regulations. There are many kinds of transaction taxes, including sales tax, value-added tax (VAT), goods and services tax (GST), and customs duties.

Oracle Fusion Tax helps enterprises to focus on tax calculations even for transactions that include locations remote from the taxing jurisdiction. Friendly user interfaces aids to rapidly familiarize with transaction tax details in Oracle Fusion Tax.

The tax architecture includes the following tiers:

- Tax Configuration: Foundation

- Tax Determining Factors

- Tax Configuration: Advanced

- Services

- Tax Management

Now let’s have a look on each of the above mentioned tiers-

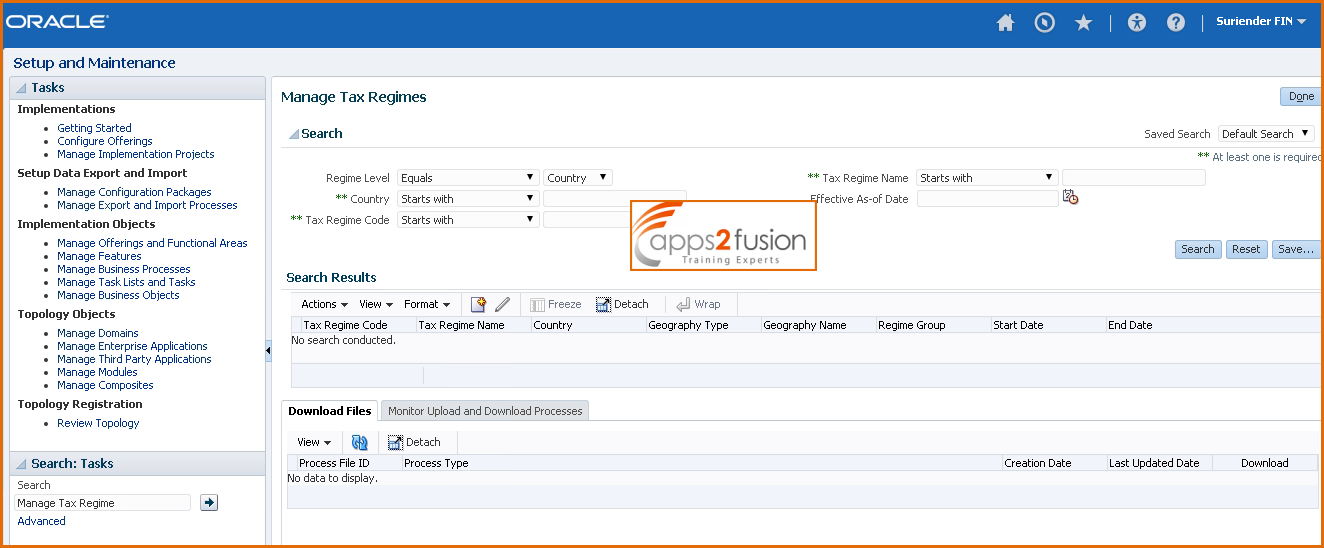

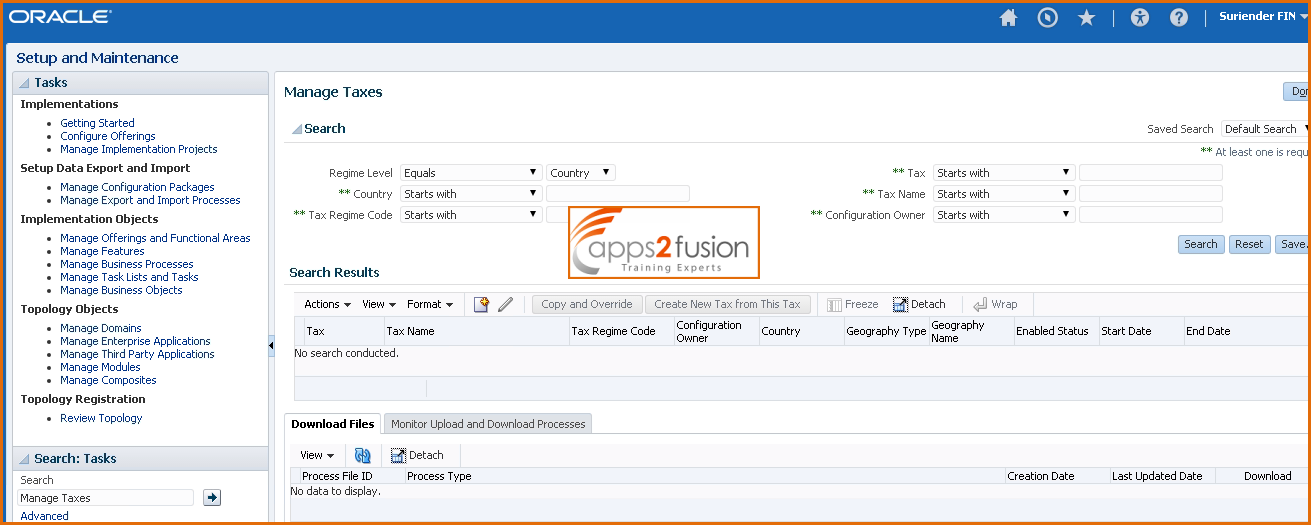

The Tax Configuration: Foundation tier consists of:

- Tax regimes and taxes, such as GST, VAT, and sales tax

- Tax jurisdiction and tax authorities, such as California and Ireland

- Tax status of different types of transactions, such as taxable or nontaxable transactions

- Tax rates including recovery rates

The Tax Determining Factors tier

The Tax Determining Factors tier identifies the factors that participate in determining the tax on an individual transaction. These taxability factors are:

- Parties to the transaction, such as your companies, vendors, and customers

- Products such as food, books, automobiles, and furniture, with each product having a different tax arrangement

- Places of shipment and delivery

- Business processes involved, such as sales, purchases, and inventory management

The Tax Configuration: Advanced tier

The Tax Configuration: Advanced tier leads you away from mainstream compliance into specialist cases. For example, the advanced configuration includes setting up tax rules to determine:

- Tax regimes

- State sales tax versus a national customs tax

- Shipment and delivery details

- Registrations, both yours and your customers and vendors

- Tax basis that results from the combinations of the above considerations

- Tax rates and recovery rates

Tax or recovery is calculated based on these and other factors. Tax recovery uses the Services tier to return the appropriate tax or recovery for the product to the entity requesting it. Other services include setup and partner integration services. Third-party tax partners deliver external data, such as tax rates, simplifying tax processing.

The Tax Management tier includes:

- Transaction taxes and related data that are stored in tax repositories and are delivered with reports. Standard reports are provided that can use or copy to customize to meet tax reporting requirements.

- Configuration data that is stored in a configuration repository. Tax records are stored in a tax record repository.

User can now calculate, account, and centrally report taxes for transactions that are created in proprietary or non Oracle applications, using Oracle Fusion Tax. Conduct this process with ease by leveraging spreadsheet-based entry options and subscribing to configurations of Oracle Fusion Tax. Depending on the type of tax transactions users enters, enterprise can use one of the taxable transaction spreadsheets or the Tax Entry Repository Data Upload spreadsheet to upload tax transaction data.

We can enter simple taxable journals to high volume transactions from external applications containing customers, suppliers, and other tax attributes for tax calculation. Tax calculation is optional for imported transactions. We can import the tax amounts as calculated by external application, or can choose to have taxes recalculated.

For lower volume transaction entry, one can use the Taxable Transaction spreadsheets provided for online validation of transaction data. These spreadsheets can be used for purchase and sales transactions and journals.

Use the taxable journals for tax calculation and recovery determination. By entering ledger and legal entity-specific data, the taxable transactions can use business unit-specific data, third-party customer or supplier details and more robust sets of tax attributes for tax determination.

For high volume transaction imports, use the Tax Entry Repository Data Upload Spreadsheet. We can load the spreadsheet data to an interface table using the predefined Tax Entry Repository Data Upload Spreadsheet and the Load Interface File for Import scheduled process, which are both part of the External Data Integration Services for Oracle Cloud feature.

This feature provides capabilities to:

- Import high volume transactions from external systems to determine, account, and report for transaction taxes centrally.

- Enter taxable transactions or journals with online validation to determine, account, and report for transaction taxes centrally.

The benefit of the manual and external tax transaction spreadsheets is to leverage Oracle Fusion Tax configuration and services to process and report transaction taxes for transactions created through any external non Oracle or legacy system.

Enterprises can now report transaction taxes at different tax points for purchase and sales invoices, including invoice date, payment date, invoice accounting date, or goods delivery date. This allows to comply with specific tax regulations and properly report on taxes for purchase and sales transactions. If the tax regulations require to determine and recover taxes on the purchase receipts, user can enable reporting on receipt for taxes with the tax point defined as Delivery. Such taxes reported on receipt are carried forward to the invoice to enable accurate payables accounting.

We can review and update tax determinants across business documents in the procure-to-pay and order-to-cash flows. These determinants on transactions are carried forward as business document progresses through its transaction lifecycle.

For a sales transaction, we can now record a specific tax registration number and location of final discharge provided by customers to accurately determine taxes. By providing these details to supplier for a purchase transaction, we can record the same details on the purchase order which is passed to the downstream transactions. If supplier shipped from a location different from the site selected for the purchase order that materially impacts the taxes, we can record the actual ship-to location on the receipt or subsequent invoice.

Comments

this, like you wrote the book in it or something. I think that

you could do with a few pics to drive the message home a little bit, but instead of

that, this is great blog. A fantastic read. I will definitely be back.

Bookmarked. Please additionally visit my site =).

We could have a link trade contract among us

I'm going to recommend this site!

website and be updated with the newest news posted here.

and I find It truly useful & it helped me out a lot. I hope to give something back

and help others like you aided me.

this website is genuinely amazing.

This article has truly peaked my interest. I'm going to take a note of your blog and keep

checking for new details about once a week. I subscribed to your RSS feed as well.

It is the little changes that will make the greatest changes.

Thanks for sharing!

writers? I'm hoping to start my own blog soon but I'm a little lost on everything.

Would you propose starting with a free platform like Wordpress or go for a

paid option? There are so many options out there that I'm totally overwhelmed ..

Any recommendations ? Bless you!

myspace group? There's a lot of people that I think would really appreciate your content.

Please let me know. Thank you

why this accident didn't happened in advance! I bookmarked it.

It appears like some of the written text in your content are running off the screen.

Can somebody else please provide feedback and let me know if this is happening to them too?

This may be a problem with my web browser because I've had this happen before.

Thank you

and be up to date every day.

page. Im really impressed by your site.

Hi there, You've done a great job. I will certainly digg it and personally suggest to my friends.

I am sure they will be benefited from this site.

of my cousin. I'm now not positive whether or not this submit is written by means of him as nobody else know such specific about my difficulty.

You are incredible! Thanks!

slow for me. Is anyone else having this issue or is it a problem

on my end? I'll check back later and see if the problem still exists.

RSS feed for comments to this post